The Challenge

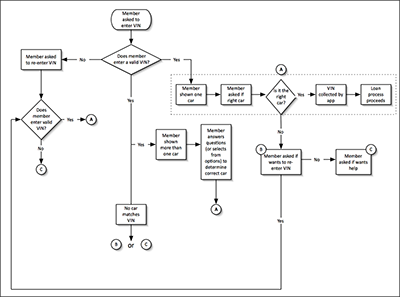

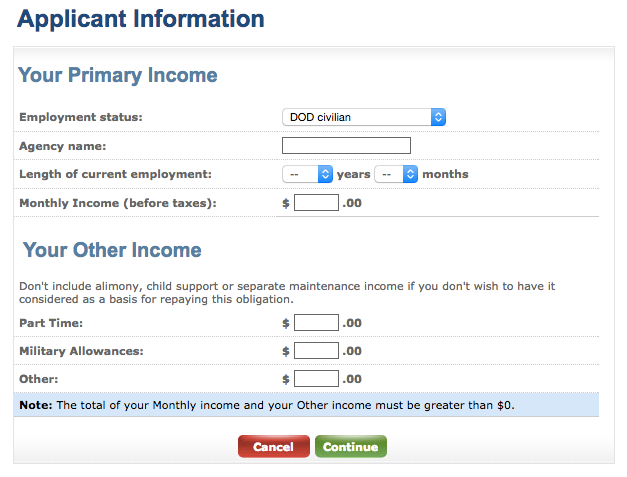

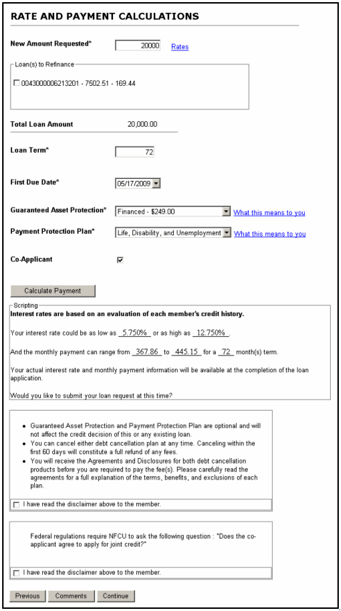

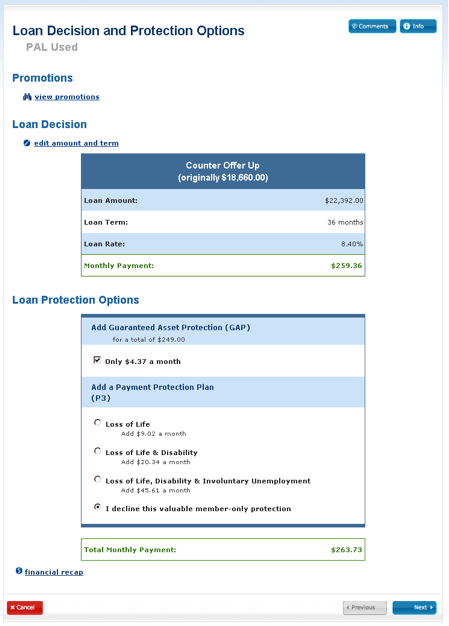

The call center for a major credit union was a critical point of contact with customers who were seeking an automobile loan. Recognizing that it was important to ensure an efficient, memorable customer experience, the credit union asked our Agile team to revamp their call center's slow and cumbersome system to make it easier for customers to purchase new cars and trade in old ones.